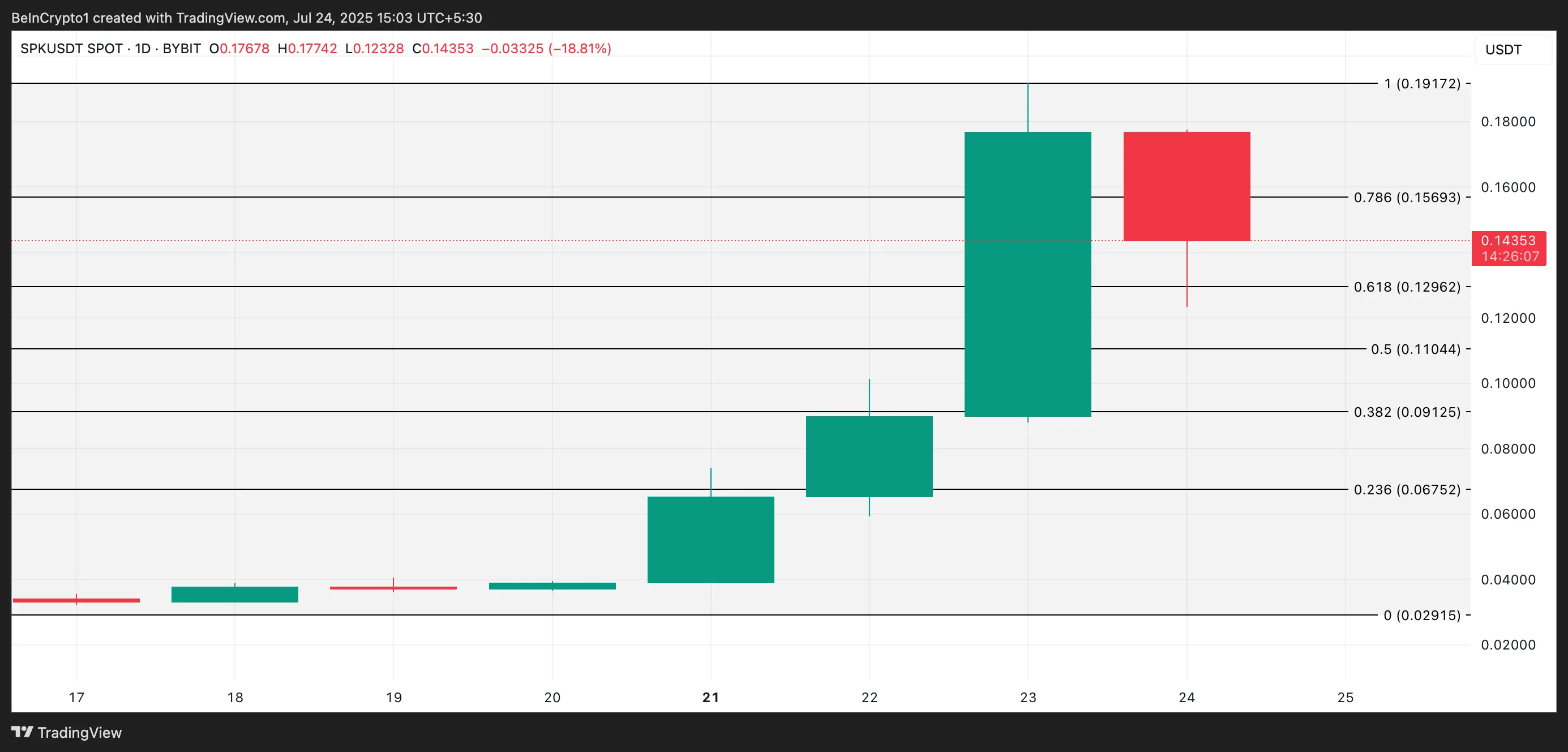

SPK, the native token of the decentralized finance (DeFi) platform Spark, surged to a new all-time high yesterday.

However, the rally was short-lived. In the hours following its peak, SPK has tumbled by almost 25%, as waves of profit-taking from holders have triggered a reversal in momentum.

SPK’s Rally Stalls: Net Outflows Surge and Bearish Bets Rise

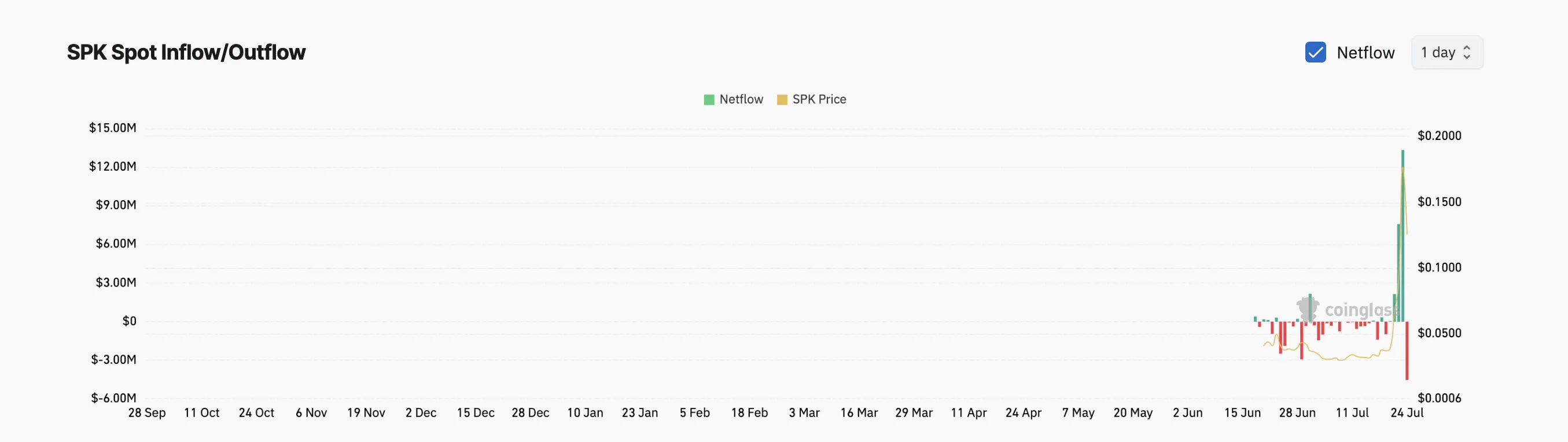

An assessment of SPK’s spot netflow provides insight into the cooling rally. According to Coinglass, the altcoin has witnessed a significant spike in net outflows from its spot markets during today’s session, totaling $4.53 million as of this writing.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A spike in spot net outflow means that more tokens are being withdrawn from exchanges than deposited. This trend reflects sell-offs by SPK holders who capitalized on the token’s month-long rally to secure profits.

Explore BYDFi: Your Gateway to Private Trading

- Trade Without KYC – Complete Anonymity

- Get a guaranteed welcome bonus up to $2,888

- Ranked among Top-10 crypto exchanges

Sponsored

As a result, downward pressure on its price has intensified, raising the likelihood of a further pullback from its all-time high.

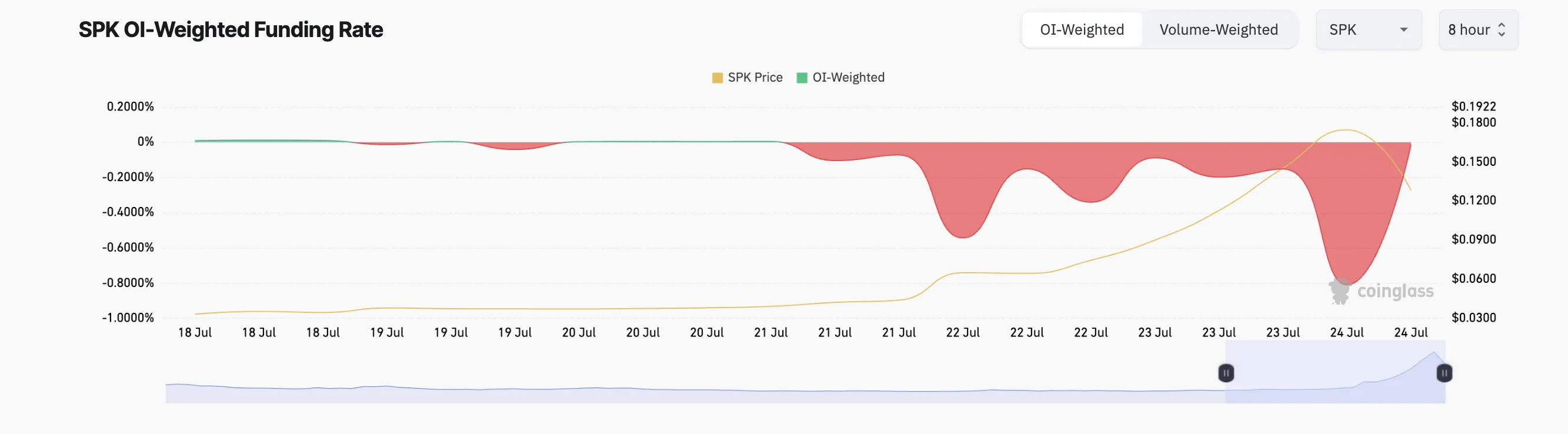

Additionally, SPK’s futures market sentiment has remained increasingly bearish. This is reflected by its funding rate, which has returned only negative values since July 21.

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the underlying asset’s spot price. When its value is negative, short sellers are paying long holders.

This indicates that bearish sentiment dominates the SPK market, with more traders betting on the price to fall.

Profit-Taking Drags SPK Lower; Will $0.12 Hold or Is $0.11 Next?

The surge in SPK net outflows and its negative funding rate suggest the token is entering a correction phase. While the token’s long-term fundamentals may remain intact as DeFi activity climbs, short-term indicators suggest that SPK may face further downside over the next few trading sessions.

In that scenario, its value could fall under $0.12 and trend toward $0.11.

However, if profit-taking stalls, SPK could regain strength and attempt a break above $0.15 to reclaim its all-time high of $0.19.

source : https://beincrypto.com