The Hedera Hashgraph network has recorded a decline in on-chain liquidity, reflected by a sharp drop in its stablecoin market capitalization.

This decline reflects a broader slowdown in user activity across the network, which could put additional pressure on HBAR’s price.

Liquidity Crunch Hits Hedera

According to DefiLlama, Hedera’s stablecoin market cap has fallen by over 30% in the past week, highlighting weakening user demand on the network.

As of this writing, the stablecoin market cap on the Hedera Hashgraph network totals $70.02 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

A decline in a network’s stablecoin market cap signals reduced liquidity and lower user engagement. Stablecoins are a key measure of on-chain activity, as they facilitate trading, payments, and other decentralized financial operations.

When their market capitalization drops, it suggests fewer participants are interacting with the network, which could translate into slower growth and lower transaction volumes.

For Hedera, this reduced demand on the network may put downward pressure on its token’s price, as liquidity dries up and investor sentiment cools.

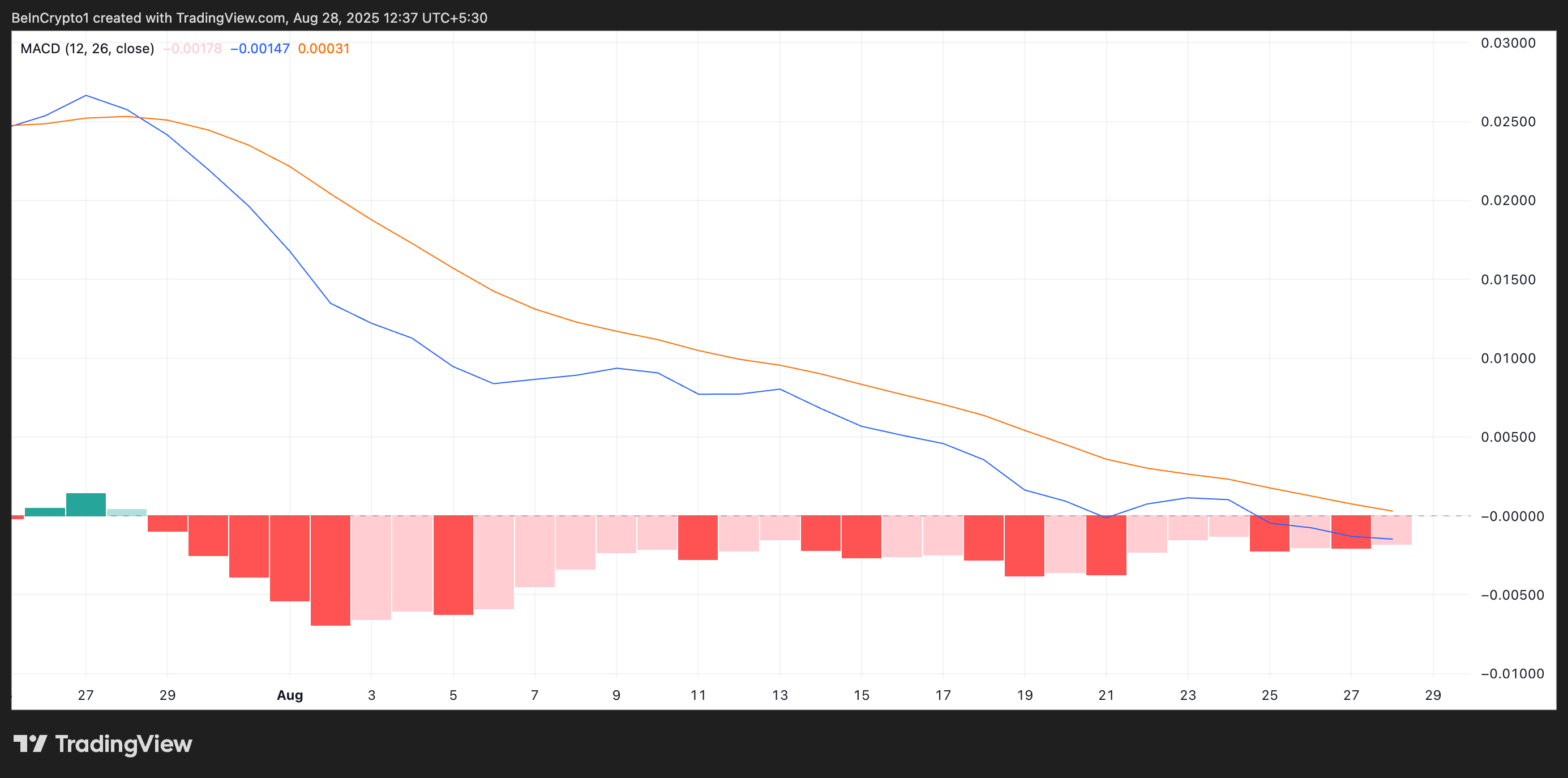

Moreover, on the daily chart, HBAR’s Moving Average Convergence Divergence (MACD) setup confirms the bearish outlook. At press time, HBAR’s MACD Line (blue) rests below its signal line, hinting at deeper losses in the near term.

The MACD indicator identifies trends and momentum in an asset’s price movement, helping traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When an asset’s MACD line (blue) falls below its signal line (orange), it indicates a breakdown in the market’s bullish structure. If this remains, HBAR could leave its narrow range and break downward.

Liquidity Slide on Hedera Could Push HBAR Toward $0.1963

HBAR currently trades at $0.2403. If bearish sentiment strengthens, the token could fall toward its immediate support level at $0.2279. HBAR’s price may dip further to $0.1963 if this support fails to hold.

On the other hand, an uptick in accumulation could invalidate the current bearish outlook. In that scenario, HBAR could rebound and break past the resistance level at $0.2509.

source : https://beincrypto.com