Ether.fi – a familiar name in the restaking space – is undergoing a strategic shift as it officially transitions into a crypto-native neobank.

From a dominant restaking platform to an ambitious leader in decentralized banking, Ether.fi is redrawing the boundaries of modern DeFi.

The Transformation of Ether.fi

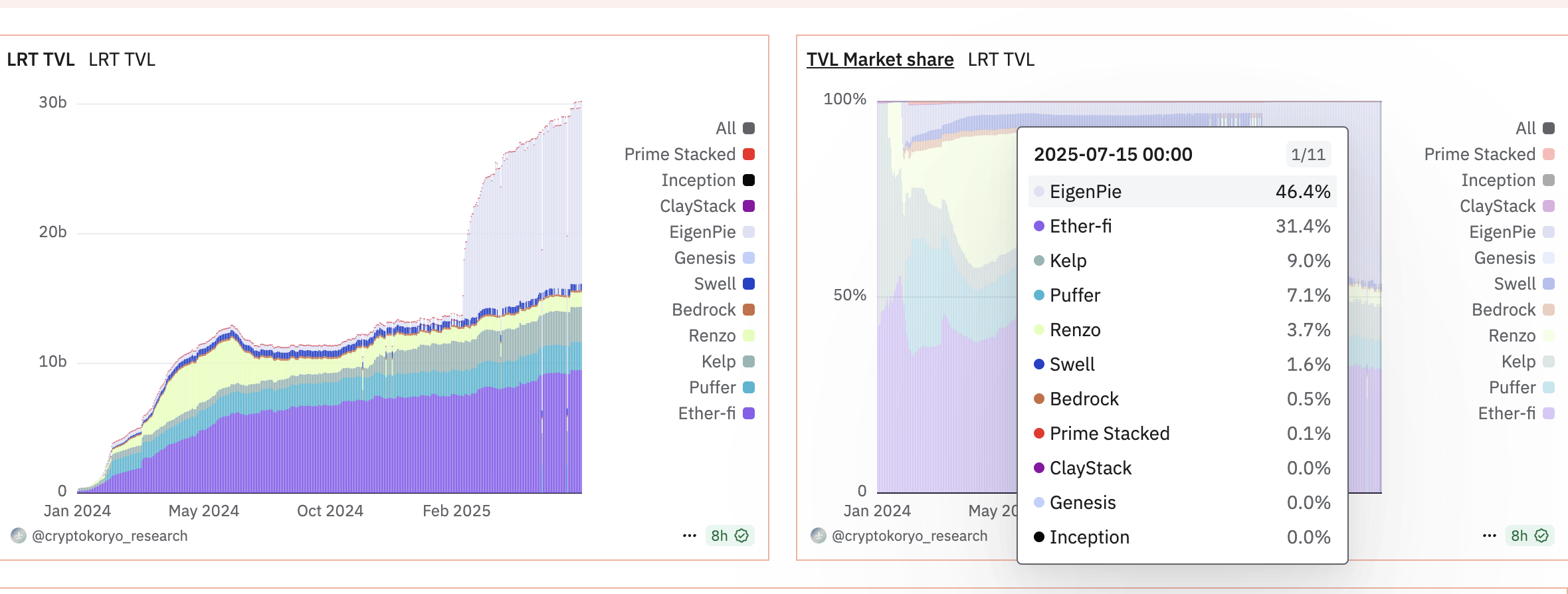

In the restaking sector, Ether.fi is one of the top players, holding a 31.4% market share. The leading position belongs to EigenPie with 46.4%.

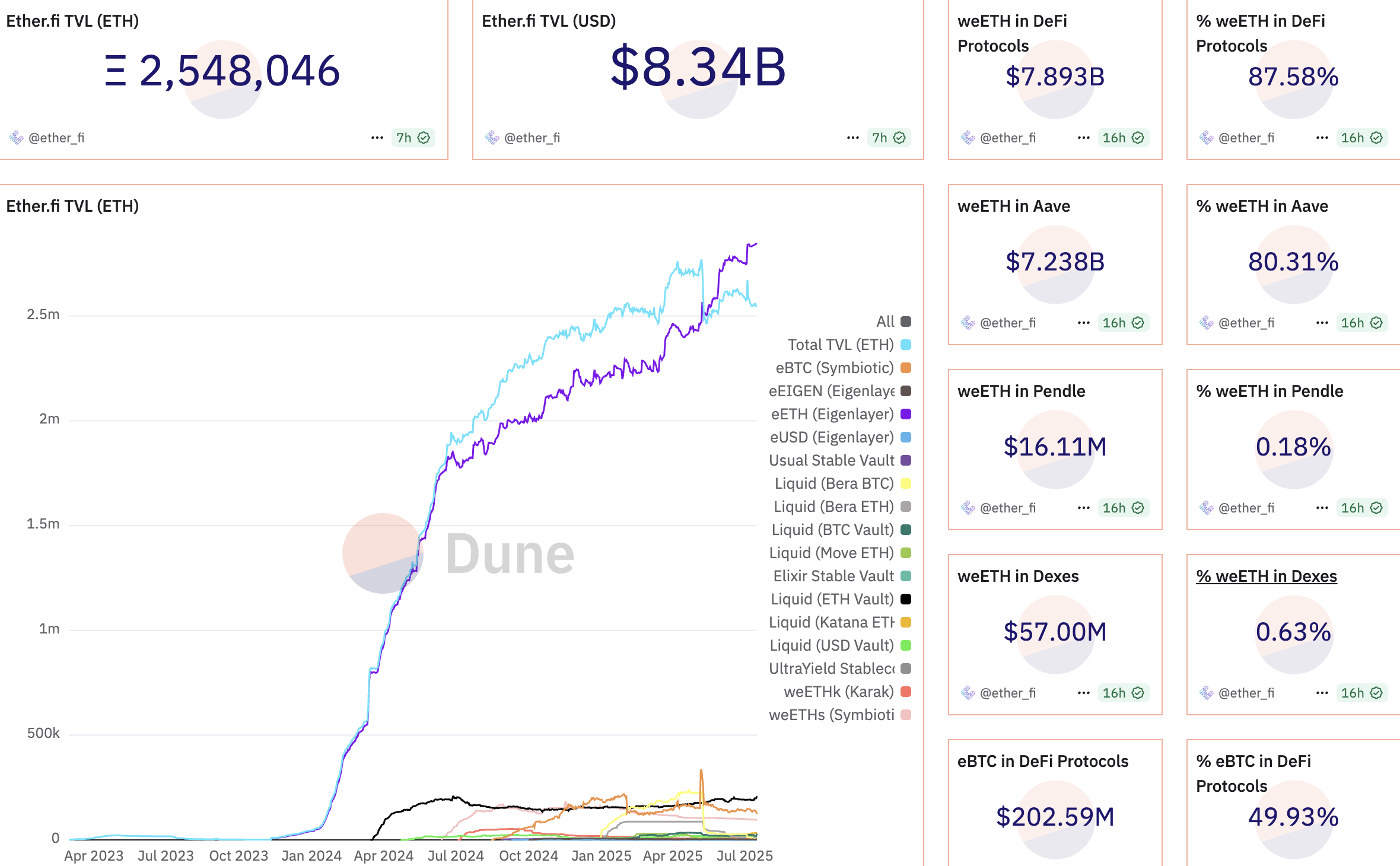

Ether.fi has recorded nearly 2.6 million ETH deposited on the platform. The current Total Value Locked (TVL) is approximately $8.34 billion. Moving beyond its role as a passive yield platform, the project is gradually implementing a digital banking model. This model aims to become a fully integrated decentralized financial ecosystem, from staking and collateralized lending to everyday spending.

Ether.fi’s new transformation strategy, in addition to diversifying its product offering in a highly competitive space, may also stem from a decline in performance. While the project still holds a significant market share, this figure has notably decreased from its previous peak.

According to Dune data, the project once held a monopoly with over 55% market share in March 2025. However, this figure has dropped to the current level in less than three months.

Ether.fi’s pivot has not been without challenges. Its first product—a non-custodial credit card launched in late April—has shown modest performance compared to the vast scale of the traditional financial market.

Moreover, Ether.fi faces fierce competition from giants like Coinbase, Revolut, and Robinhood. These companies already boast millions of retail users and well-established financial ecosystems.

A potential issue lies in the sustainability of the 3% cashback program. Currently, these rewards are subsidized by the SCR token of Scroll, which accounts for 50% of the TVL on the Scroll network. However, if transaction volumes increase rapidly, the cost of maintaining the cashback program could become unsustainable. This might force Ether.fi to adjust the cashback rate or explore alternative revenue streams.

“Despite these challenges, Ether.fi’s product suite is structurally compelling, with each offering designed to drive demand for the others through tight vertical integration. Combined with multiple tailwinds (TradFi firms adding ETH to balance sheets, rising stablecoin adoption, record ETH ETF inflows), the setup looks promising for accelerated growth over the coming months.” An X user commented.

Overall, Ether.fi’s transformation is a clear sign that DeFi protocols are increasingly converging with traditional banking models – but in a more decentralized and transparent way. As capital from traditional institutions begins to flow into the Ethereum market through vehicles such as spot ETH ETFs, Ether.fi may be well-positioned to ride these favorable winds to scale up its influence.

Nonetheless, sustaining growth momentum, maintaining user trust, and balancing short-term gains with long-term vision remain key challenges for the team behind the project.

source : https://beincrypto.com