Coinbase officially completed its Deribit acquisition, leading to a large boost to stock prices. Through this arrangement, the platform will soon offer many new derivatives services to a massive user base.

Promised new features include perpetuals contracts and options alongside spot and futures trades. Still, Coinbase is working to construct these services, and it’s not clear when they’ll launch for all customers.

Coinbase’s Deribit Deal

Coinbase, one of the world’s largest exchanges, has intended to expand its presence in the derivatives market for years now. Over the past few months, it’s been making these plans a reality.

After months of negotiations and a purchase three months ago, Coinbase finally completed its Deribit acquisition today.

The biggest logo x logo partnership in crypto just became official.

We closed the deal with @DeribitOfficial. Now we’re building the most powerful global crypto platform, together. pic.twitter.com/a7fCmx3E6T

— Coinbase 🛡️ (@coinbase) August 14, 2025

Deribit is a major derivatives exchange, but it began considering acquisition offers alongside a few regulatory setbacks. By integrating with Coinbase, Deribit will be able to offer a full range of services to a vast consumer base.

Sponsored

Before acquisition, the firm already had roughly $60 billion of current platform open interest, but Coinbase’s market profile is even larger.

With this partnership, Coinbase will be closer to providing a full range of trading products, including spot, futures, perpetuals contracts, and options.

Long-Term Benefits

Naturally, this Deribit acquisition has brought Coinbase a lot of notoriety. When it first opened negotiations, stock prices rose, proving to be one of the largest bright spots in an otherwise underwhelming Q1 2025.

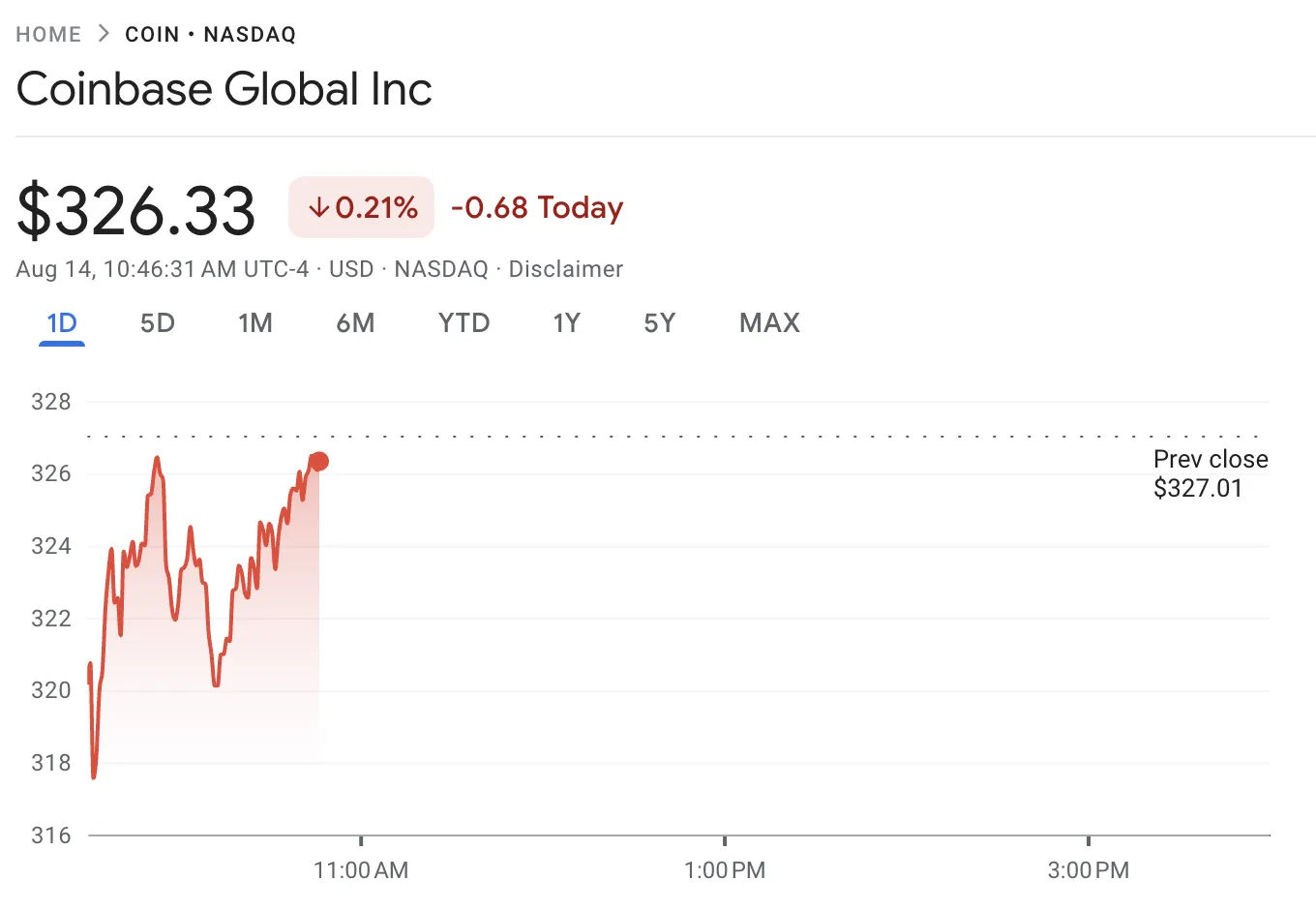

When they reached an agreement in May, this boosted Coinbase’s stock by 37% in one month. Today, we’re seeing similar market optimism:

The firm’s stock fell in after-hours trading from yesterday evening, so this morning’s price actions have been a little chaotic. Despite another brief dip, the upward motions have been very dramatic, and there is momentum for more gains.

Still, Coinbase’s press release was very careful on one point: Deribit integration won’t happen immediately. Instead, it calls it a “major step forward,” “bringing us closer” to offering new derivatives products.

These services should hopefully be available soon, but they’ll require some dedicated construction efforts.

source : https://beincrypto.com