JD.com, China’s second-largest e-commerce company with over $150 billion in annual revenue, has quietly posted a job opening for a DeFi expert. The retail giant is seeking talent deeply familiar with DEXs, lending, derivatives, and token economics.

This move comes as Hong Kong’s stablecoin licensing regime officially took effect on August 1. The new rules offer a compliant gateway for major companies to issue fiat-pegged digital currencies.

Leveraging PayFi for Supply Chain Finance

Beyond stablecoins, JD’s job description hints at a bigger vision: PayFi, or Payment Finance. This model uses smart contracts to merge payments with programmable financial services.

In practice, a supplier could receive an on-chain receivable token immediately after JD confirms delivery. That token could be collateralized in DeFi for instant liquidity or split into smaller units. It could also be used directly to pay upstream vendors. JD can tokenize real-world assets such as receivables, warehouse receipts, and logistics orders. This unlocks massive value across its trillion-dollar supply chain.

JD’s approach contrasts with other Chinese tech giants. While competitors like Ant Group focus on compliance tools and Tencent stays policy-safe, JD differs. JD is taking a two-pronged path.

Domestically, its “Zhizhen Chain” (智臻链) continues serving regulated industrial blockchain applications such as anti-counterfeiting and e-CNY integration. Offshore, JD aims to become a direct Web3 player—issuing stablecoins, building DeFi ecosystems, and exploring tokenized finance. This balance of compliance at home and innovation abroad could give JD a unique competitive edge.

From E-Commerce Giant to Onchain Economy

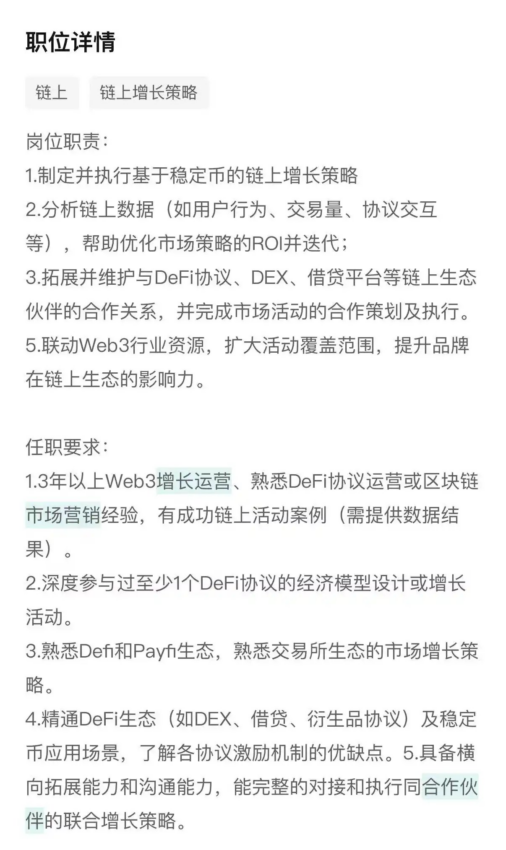

JD’s entry into DeFi reflects growing convergence between Web2 and Web3 companies. The e-commerce giant is leveraging its scale and capital to integrate blockchain finance into business operations.

Regulatory hurdles and user adoption remain significant challenges, but JD’s dual-track approach could provide competitive advantages if executed successfully.

source : https://beincrypto.com