Pi Coin has recently faced a challenging price action, culminating in the formation of a new all-time low (ATL) earlier last week.

Despite the ongoing downtrend, Pi Coin remains close to hitting a new ATL, as investor sentiment continues to worsen, reflecting a lack of optimism in the market.

Pi Coin Holders Are Choosing Not To Hold

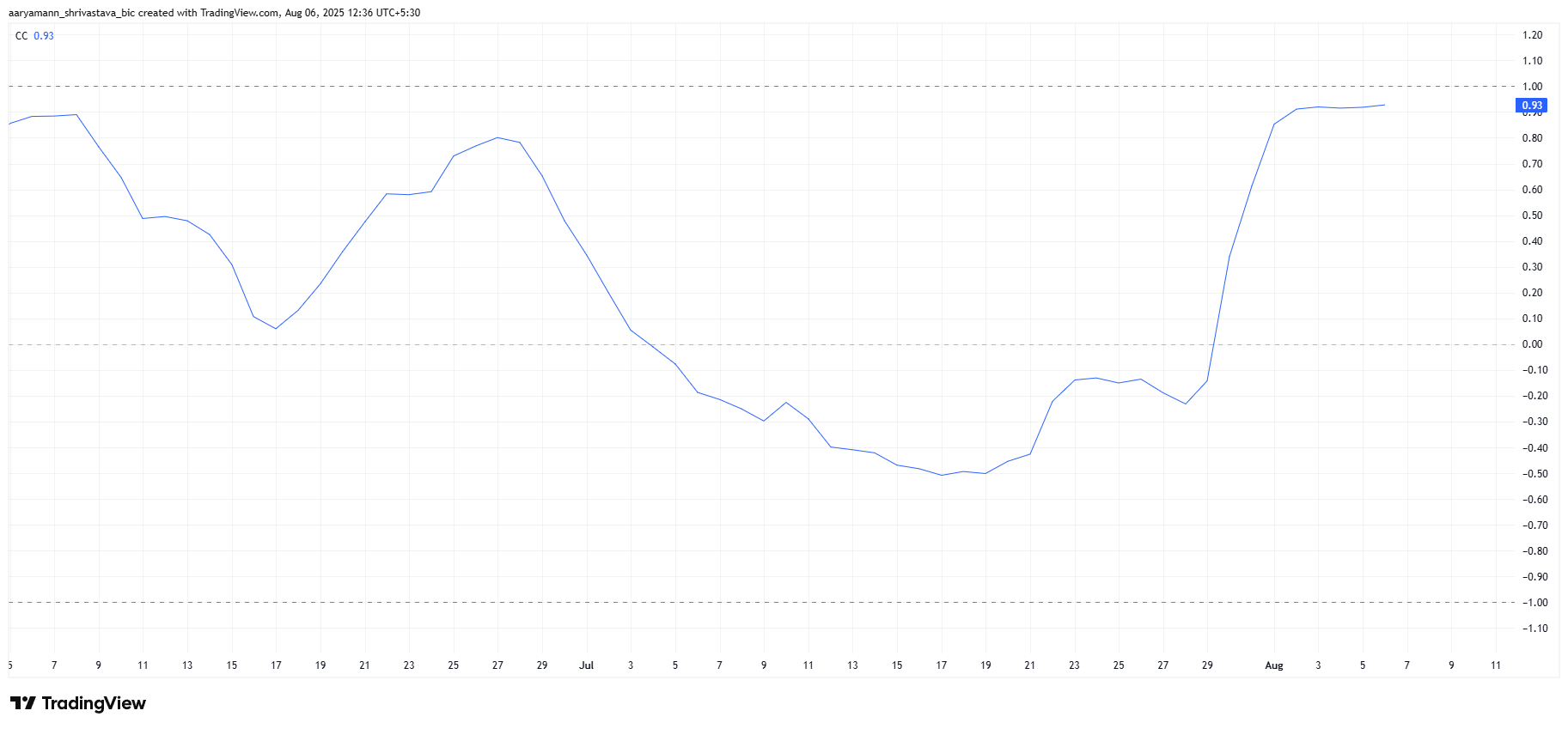

The correlation between Pi Coin and Bitcoin currently stands at 0.93, indicating a strong connection between the two assets. As Bitcoin experiences volatility and uncertainty, Pi Coin tends to follow its trajectory.

With Bitcoin’s price wobbling in recent days, Pi Coin’s price remains susceptible to the same market conditions. Bitcoin’s price uncertainty is a critical factor, as it often drives Pi Coin’s movements.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

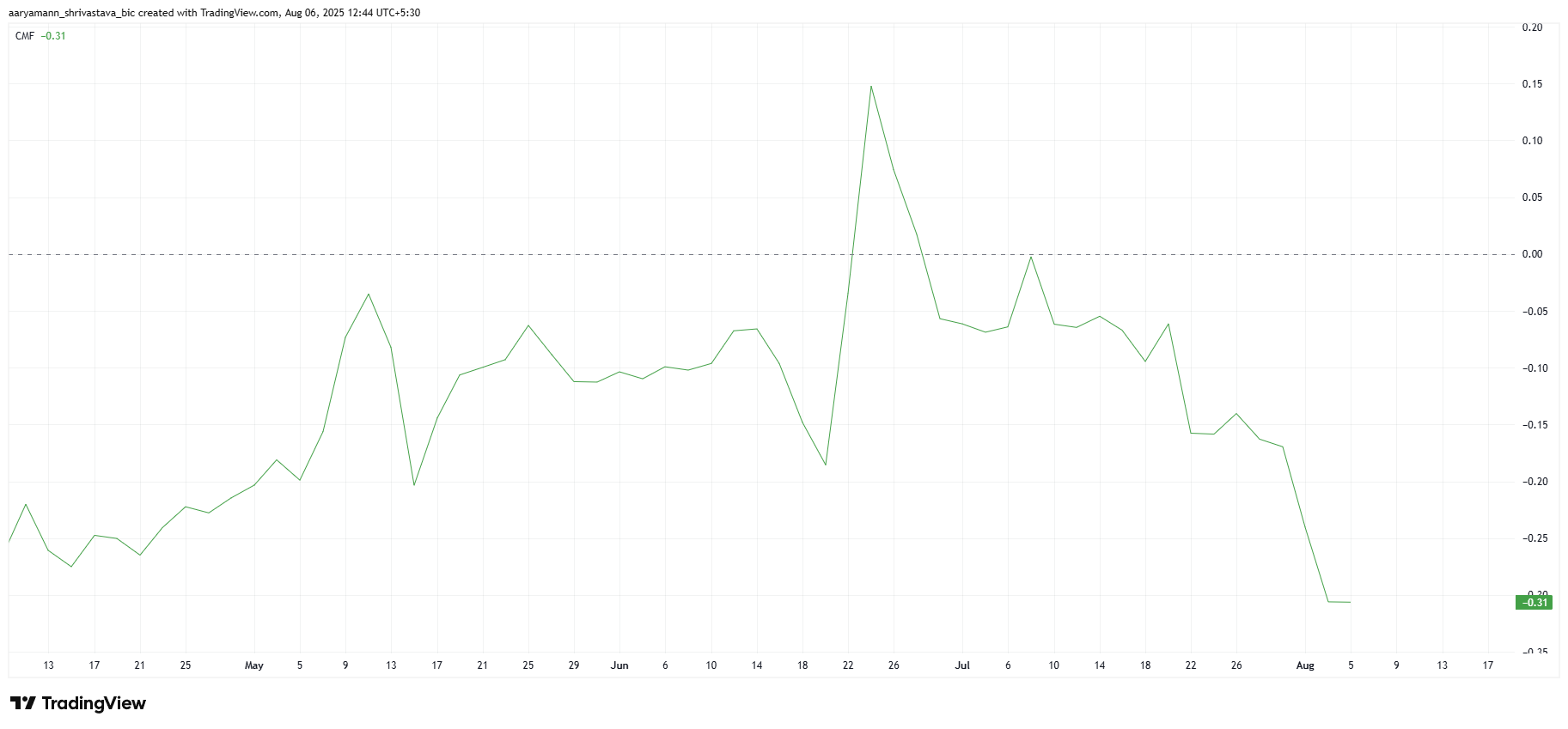

Pi Coin’s macro momentum is dominated by negative investor sentiment, as evidenced by the Chaikin Money Flow (CMF) indicator. The CMF has been steadily declining, showing that outflows are overwhelming inflows.

The continued decline in investor confidence is contributing to the overall negative momentum. This suggests that investors are bearish toward Pi Coin, with a significant portion of the market opting to sell their holdings.

Can Pi Price Bounce Back?

Pi Coin’s price is currently at $0.340, just 5.54% away from revisiting its recent ATL of $0.322. Given the current market conditions, Pi Coin remains under significant pressure, making it likely that the price will continue to decline. A new ATL below the current $0.310 could be in the near future.

Given the ongoing outflows and the correlation with Bitcoin’s price movements, Pi Coin’s price trajectory appears bleak. It’s expected that the price will maintain its downtrend unless a shift in investor sentiment occurs. A decline through the support levels is highly probable, pushing the price toward further losses.

However, in the unlikely scenario that Pi Coin experiences a reversal, it would need to secure $0.362 as a support floor to initiate a rally. If the price manages to break this barrier, it could rise to $0.401, invalidating the current bearish outlook and offering hope for a price recovery.

source : https://beincrypto.com