Two large Ethereum investors are seizing the recent market correction to increase their stakes in the asset.

In the first few days of August, the whale wallets collectively spent over $400 million on ETH, signaling renewed confidence in the asset’s long-term value.

Ethereum Whales Buy the Dip as On-chain Activity Rises

One of the most notable transactions came from a wallet tracked by Arkham Intelligence. Over a three-day period, the wallet acquired roughly $300 million worth of ETH via Galaxy Digital’s over-the-counter trading desk.

The wallet currently has an unrealized loss of around $26 million.

Somebody is buying a TON of ETH.

In the past 3 days, this address has accumulated $300M of ETH from Galaxy Digital OTC.

It’s currently worth $274M, with this address down $26M or 8.7% so far.

Address: 0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3 pic.twitter.com/pB9Foxm1wx

— Arkham (@arkham) August 3, 2025

However, the sheer scale and rapid pace of the purchases suggest a strategic, long-term accumulation rather than speculative short-term trading.

Sponsored

Another key player in this buying spree is Ethereum-focused firm SharpLink.

According to Lookonchain, the company added 30,755 ETH to its balance sheet over the span of two days, spending $108.57 million at an average price of $3,530 per token.

SharpLink now holds 480,031 ETH, with its current stash valued at approximately $1.65 billion.

SharpLink(@SharpLinkGaming) received another 15,822 $ETH($53.9M) 6 hours ago.

They spent 108.57M $USDC to buy 30,755 $ETH in the past 2 days, with an average buying price of $3,530.

SharpLink now holds a total of 480,031 $ETH($1.65B).https://t.co/fWtEg2UYB8 pic.twitter.com/EX6r4mQXCY

— Lookonchain (@lookonchain) August 3, 2025

These acquisitions came as Ethereum dropped to a multi-week low near $3,300. According to data from BeInCrypto, ETH has recovered slightly and is trading around $3,477 at the time of writing.

Industry experts noted that these whale activities are reflective of a broader, optimistic outlook for Ethereum.

In July, ETH surged past $3,900, driven by record institutional inflows, growing ETF exposure, and stablecoin-driven DeFi expansion.

Experts argue that this is not a short-lived rally but a sign of Ethereum’s expanding role in global finance.

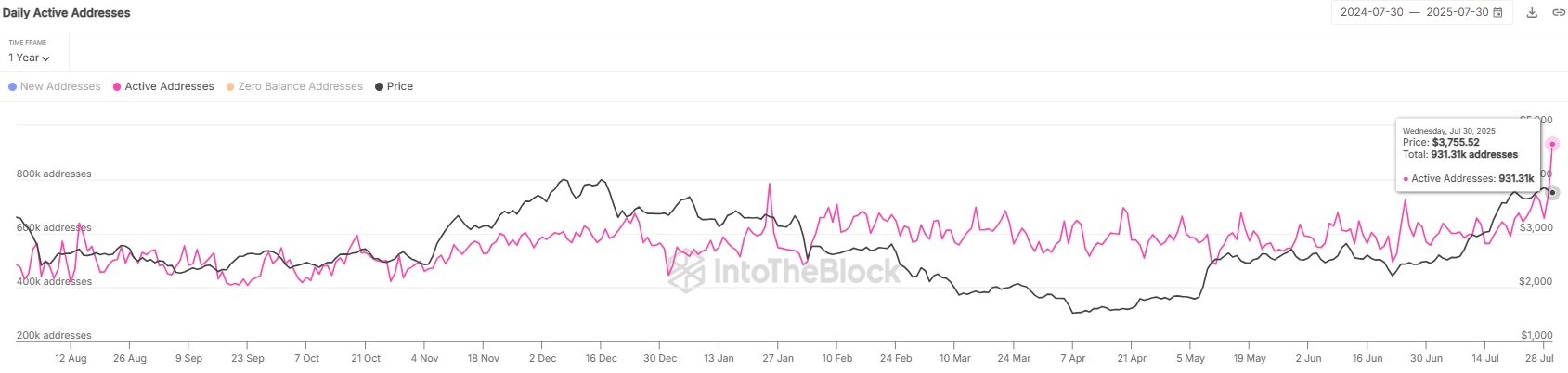

A surge in the network’s on-chain activity supports this view.

Sentora (formerly IntoTheBlock) recently reported that Ethereum registered 931,000 active addresses in a single day, its highest count in nearly two years. This uptick highlights rising user engagement and interest across the network.

Additionally, regulatory trends may further strengthen Ethereum’s outlook as US officials are willing to lead global finance into a blockchain-based era.

Popular venture capitalist Thomas Lee of Fundstrat suggested that if Ethereum continues to dominate as the preferred smart contract platform for Wall Street firms, its valuation could rise significantly, potentially reaching $60,000.

source : https://beincrypto.com