The price of the leading altcoin, Ethereum, continues to drift further from the $4,000 mark. Recent profit-taking and cautious sentiment weighing heavily on market momentum have caused ETH price to decline significantly from its July peak of $3,941.

On-chain and technical indicators now suggest a growing likelihood of a pullback below $3,000 in the coming weeks.

ETH Faces Headwinds as Accumulation Dips and Bearish Signals Mount

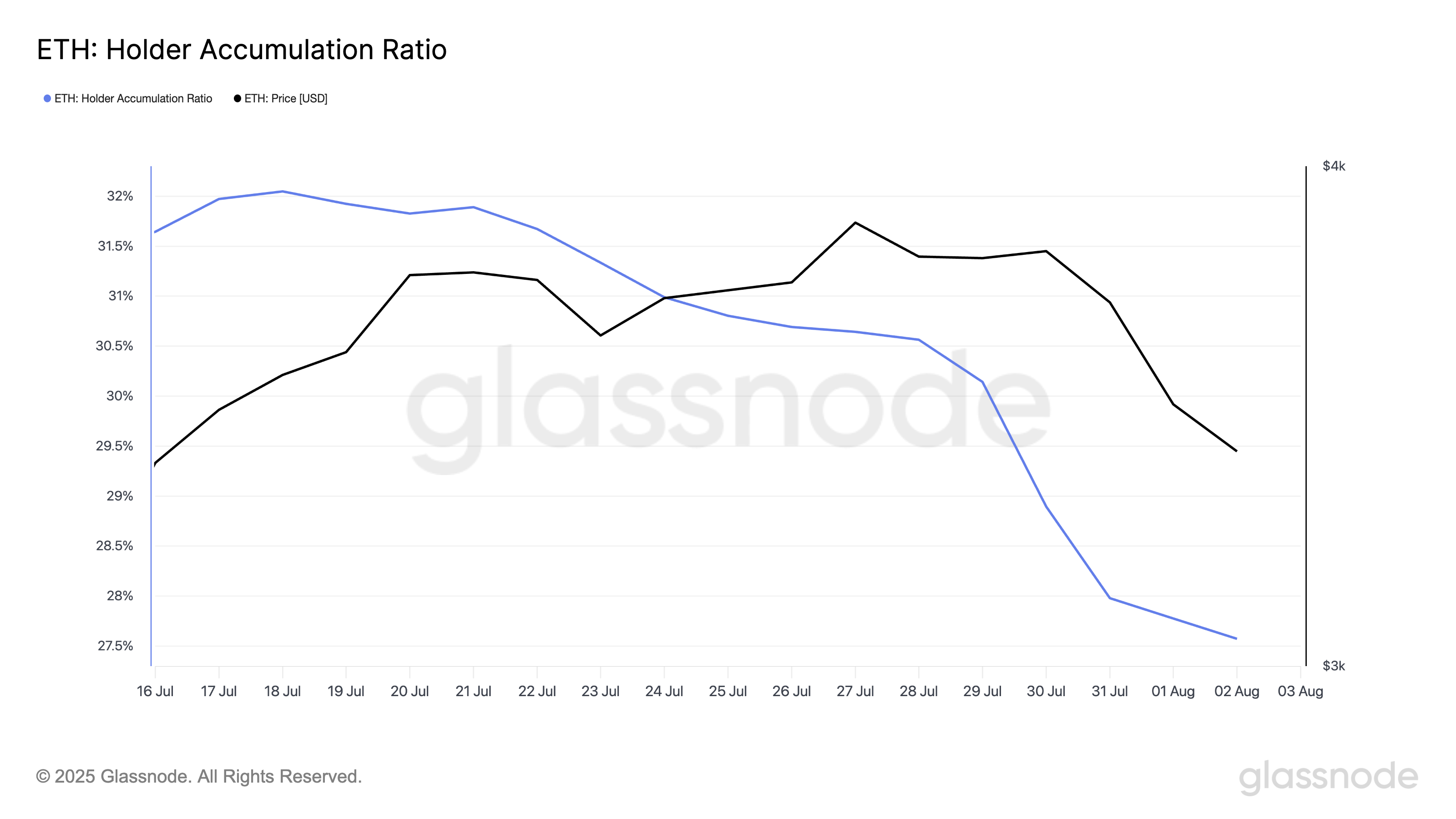

Glassnode data shows that Ethereum’s Holder Accumulation Ratio closed at a two-month low of 27.57% on Saturday, a sign that investors are no longer aggressively adding to their ETH holdings.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

According to the on-chain data provider, this metric measures the percentage of existing addresses increasing their ETH balances relative to those reducing or maintaining theirs.

Sponsored

When it climbs, it indicates accumulation behavior — typically seen during bullish phases when confidence in future price growth is high.

On the other hand, a declining ratio, such as the one currently observed, signals weakening conviction and a reluctance to buy the dip. With fewer holders accumulating, ETH lacks the buy-side pressure typically needed to sustain a rebound.

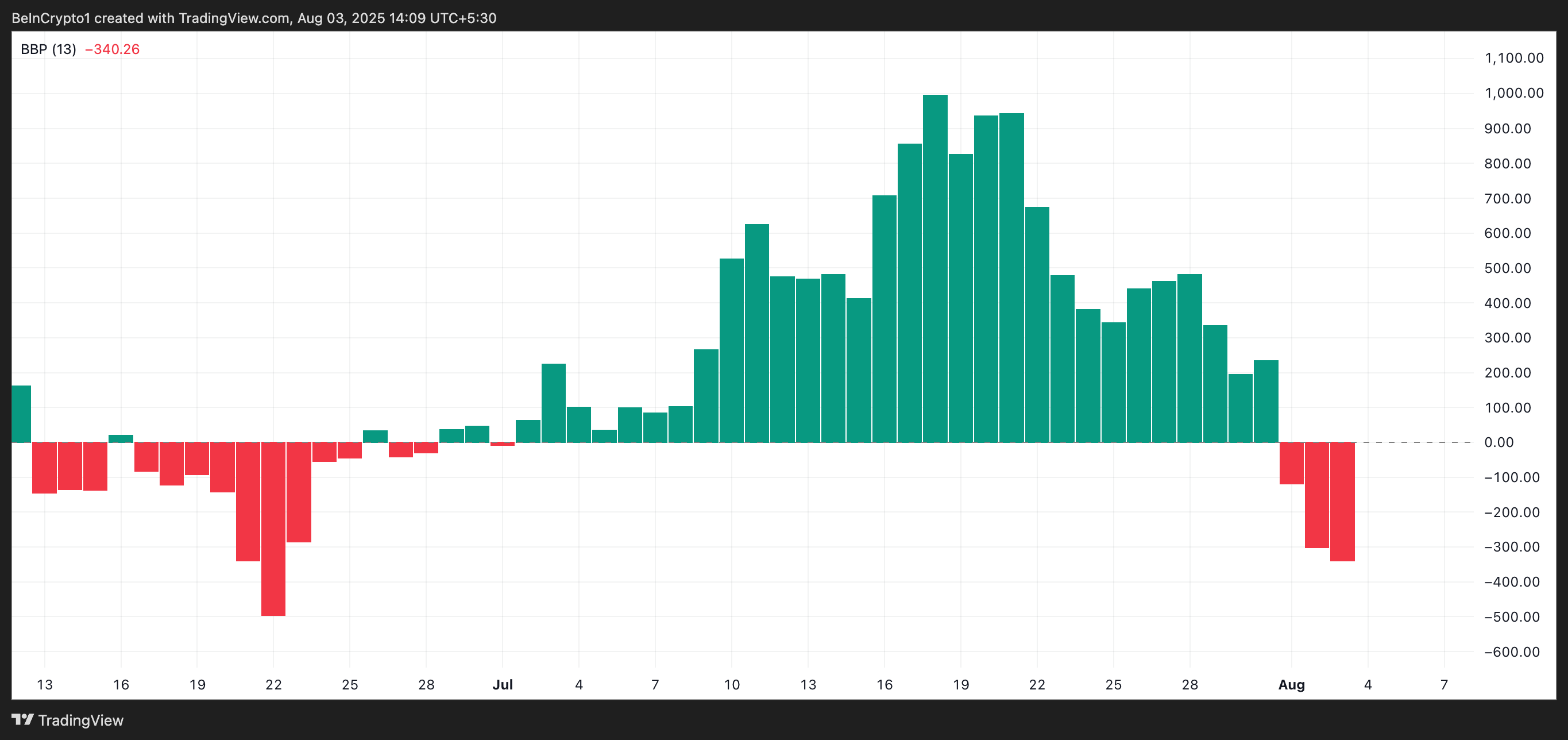

Furthermore, ETH’s Elder-Ray Index has posted red histogram bars over the past three trading sessions, confirming that the bears have sidelined the bulls. As of this writing, it stands at -342.73.

The indicator gauges the strength of bulls and bears in the market. When it prints green histogram bars, it indicates strong buyer dominance and rising upward momentum.

Conversely, as with ETH, bearish momentum grows when it returns red bars whose sizes continue to enlarge. These red bars indicate that selling pressure is not just present but increasing as the day passes.

ETH Eyes $2,745 as Buyers Step Back

ETH currently trades at $3,457, just below a key resistance level formed at $3,524. If accumulation weakens, bearish momentum could drag the price down toward the next major support at $3,067.

Should this support floor give way, ETH may slip further to test the $2,745 zone.

Converesly, a renewed wave of demand could shift sentiment and fuel a recovery. In that case, ETH might make another attempt to break above the $3,524 resistance. A successful breakout could pave the way for an extended rally toward the $3,859 level.

source : https://beincrypto.com