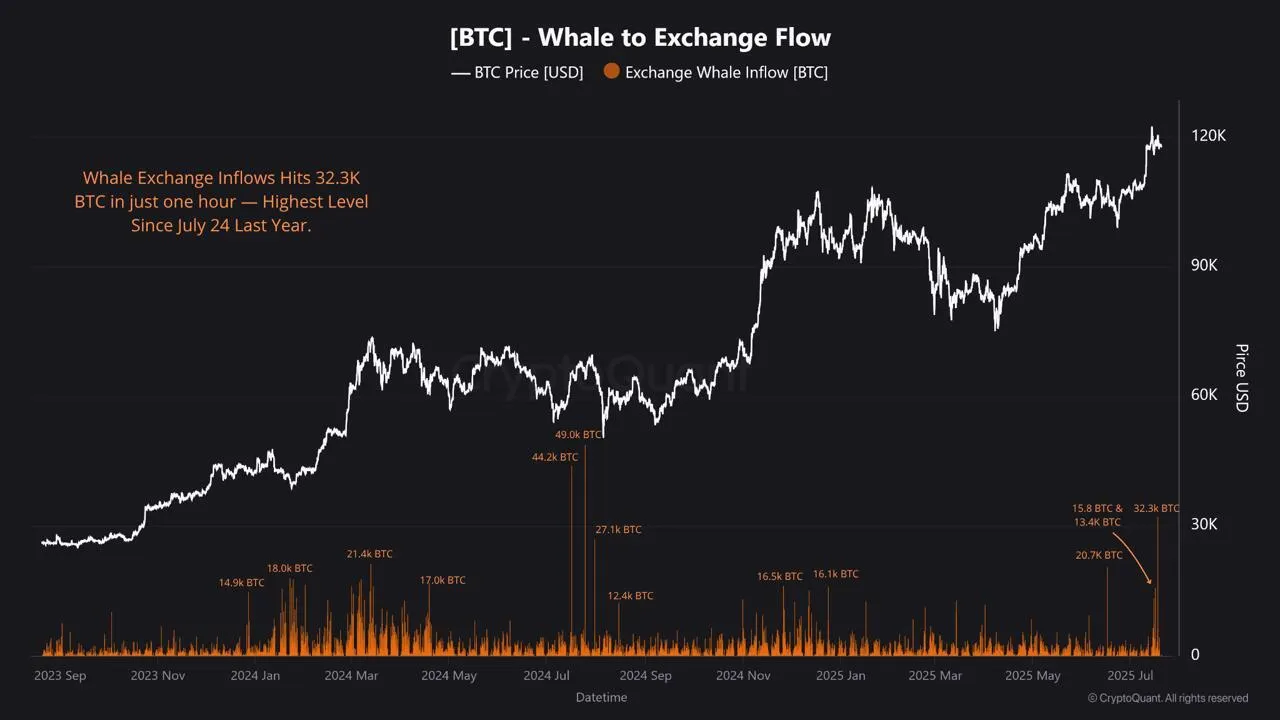

CryptoQuant data shows that Bitcoin whales sent over 61,000 BTC to exchanges on July 17—the largest single-day inflow in a year.

This sudden surge in whale deposits coincided with a sharp drop in Bitcoin dominance, raising questions about whether capital is rotating into altcoins.

Whale Activity Suggests Bitcoin Is Consolidating

According to data and analysis from CryptoQuant analyst JA Maartun, 32,300 BTC flowed into exchanges in just one hour on July 17. That followed two earlier transfers of 15,800 BTC and 13,400 BTC from wallets holding over 100 BTC.

These large movements typically signal profit-taking, especially after Bitcoin hit a new all-time high of $123,000 on July 14.

Following the whale inflows, Bitcoin price pulled back and is now trading between $117,000 and $118,000.

Explore BYDFi: Your Gateway to Private Trading

- Trade Without KYC – Complete Anonymity

- Get a guaranteed welcome bonus up to $2,888

- Ranked among Top-10 crypto exchanges

Sponsored

Most importantly, the timing aligns with a steep decline in Bitcoin dominance, which fell from 64% to 60% between July 17 and July 21.

A falling dominance metric often indicates that investors are rotating out of Bitcoin and into altcoins. This trend is one of the earliest signs of an emerging altcoin season.

When Bitcoin stabilizes and capital flows into Ethereum, Solana, and mid-cap tokens, altcoins tend to outperform.

Bitcoin’s short-term outlook now leans toward consolidation. If whales continue to sell, further downside pressure is possible.

However, current price support around $115,000 remains intact for now.

Meanwhile, the altcoin market is gaining strength. Ethereum, XRP, and Solana have posted double-digit gains in the past week. The meme coin market cap alone has surged 8% today, nearing $90 billion.

The Altcoin Season Index also climbed from 32 to 56, further supporting the shift in market momentum.

In summary, whale activity appears to be cooling Bitcoin’s rally while quietly fueling altcoin gains. The next move depends on whether buyers absorb the sell pressure or if another wave of whale selling occurs.

Overall, this is a cooling-off period for Bitcoin and the beginning of momentum for altcoins. Keep watching whale flows and BTC.D for confirmation of the next phase.

source : https://beincrypto.com